In This Issue

Vol. 27 Issue 20

MANUFACTURING INFLATION

- TOO MUCH HOT MONEY

- CHINA’S ROLES

- PRODUCTIVITY, THE UMBRELLA PROBLEM

MORE FROM SNS

QUOTES

MEMBER SPOTLIGHT

ETHERMAIL

OUR PARTNERS

WHERE’S MARK?

—

When I predicted the 2007 recession, on CNBC TV’s Power Lunch Europe in London that March, it was a big risk that worked out. In hindsight, there were two very interesting aspects to this call:

- It was ultimately based not on real-estate prices (the subset that many folks reacted to), but on too much hot money in the global economy. (For the complete analysis, see The Pattern Future: Finding the World’s Great Secrets and Predicting the Future Using Pattern Discovery.) And

- Not a single professional economist saw it coming.

Today, as inflation turns into a white-hot problem, I have the same eerie feeling: all the economists are talking about the old-school models and missing most of the causes that are front and center.

Many of us, in all walks of life, are echoing the opposite sentiments from those on the front pages of the Wall Street Journal and the New York Times; in other words, this time feels different, the causes don’t make a lot of sense, and no one in control seems to know what’s happening or, therefore, how to fix it.

All true.

It doesn’t help when, for instance, the Economist runs a cover like this, from this week:

. . . for at least two reasons:

- As SNS members know, we announced the China economic slowdown, even then out of the control of China’s leaders, in January 2015; its economy has been in slow-motion implosion since then, now seven years ago; and

- The problem is not President Xi’s new model (threatening big-tech companies, etc.), but his old model, which is – and always was – unsustainable.

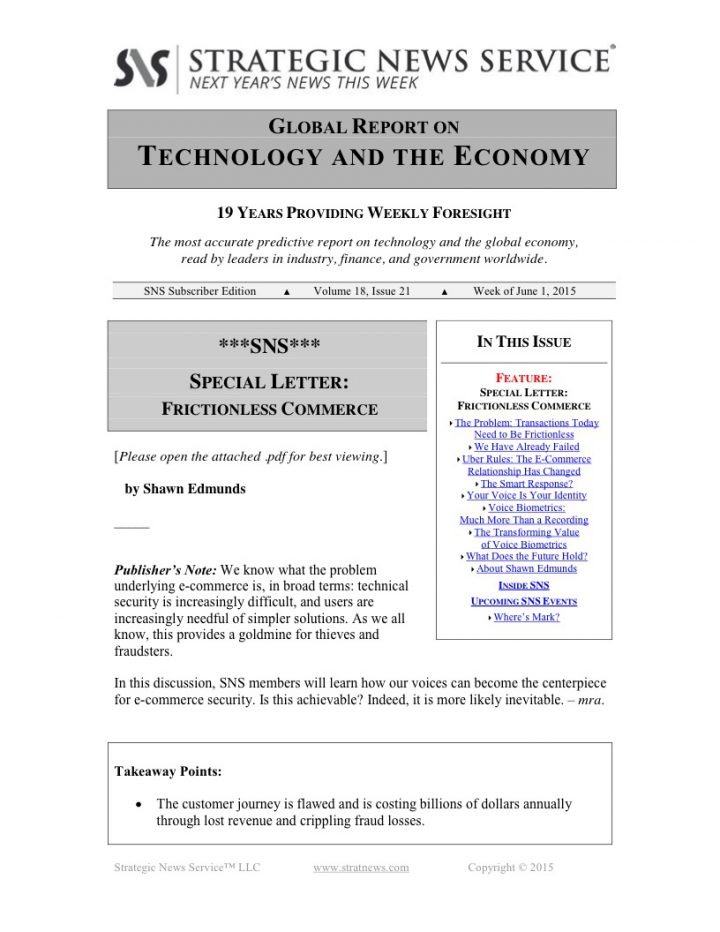

It also doesn’t help when, for instance, a story on inflation at the top of the front page of the Saturday NYT starts with a very confusing conflation of MTM and YTY figures:

. . . showing that, as of Saturday, US inflation is 6.0% YTY without fuel and food (see chart), then says it is 0.6% – apparently MTM – in the second paragraph.

No wonder people think this issue is essentially both incomprehensible and not being well-understood. A survey last week found that the strong majority of US consumers believe inflation will be worse or much worse next year, with no relief in sight.

Perhaps it would help, for our broader audience, to give a quick definition of “inflation,” from www.nytimes.com:

What is inflation? Inflation is a loss of purchasing power over time, meaning your dollar will not go as far tomorrow as it did today. It is typically expressed as the annual change in prices for everyday goods and services such as food, furniture, apparel, transportation and toys.

In other words, the same things cost more over time.

In this week’s issue, we’ll look at the question of whether this time things really are, in some ways, different, even as the usual pressures also matter. But let’s be clear at the outset: the usual pressures alone – i.e., those pressures which, for instance, accounted for the 1980 peak – are not the same as those today. And worse, the biggest are not getting mentioned at all.

SKU: SNS-2022-06-14 - Need Help? Contact Us Leave Feedback

Categories: 2022 Issues, Back Issues

Tag: PDF Download